- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Fed rate decision, jobs, tariffs and deals, deals, deals

Howdy market watchers!

August is here, but surprisingly not the heat, at least not to begin the month. Undoubtedly, there will be more ahead, but any break this time of year is more than welcome! We’re even being blessed with rain as we enter the back half of the year and soon, back-to-school. Where does time go?!

President Trump continues to waste no time in making headlines. This week has been full of them, again. Ahead of the August 1st tariff escalation deadline, deals were getting done. The most notable this week was the deal with the European Union. While conversations with China resumed this week in Sweden and expectations were at least for an extension to be announced on Monday or Tuesday, there was neither a deal nor an agreement on an extension, but that deadline isn’t until August 12th and so there is still time for a deal to be made, or an extension granted. Mexico was granted a 90-day extension with favoritism showed as Canada was not granted such an extension.

If you haven’t heard the meme, TACO (Trump Always Chickens Out), that is an expectation as deadlines approach. While some extensions have been granted, by no means have all the tariff cans been kicked down the road. Many of the tariffs actually go into effect on August 7th and so technically, there is still time for deals to be made next week. Therefore, expect another week of tariff headlines and market volatility.

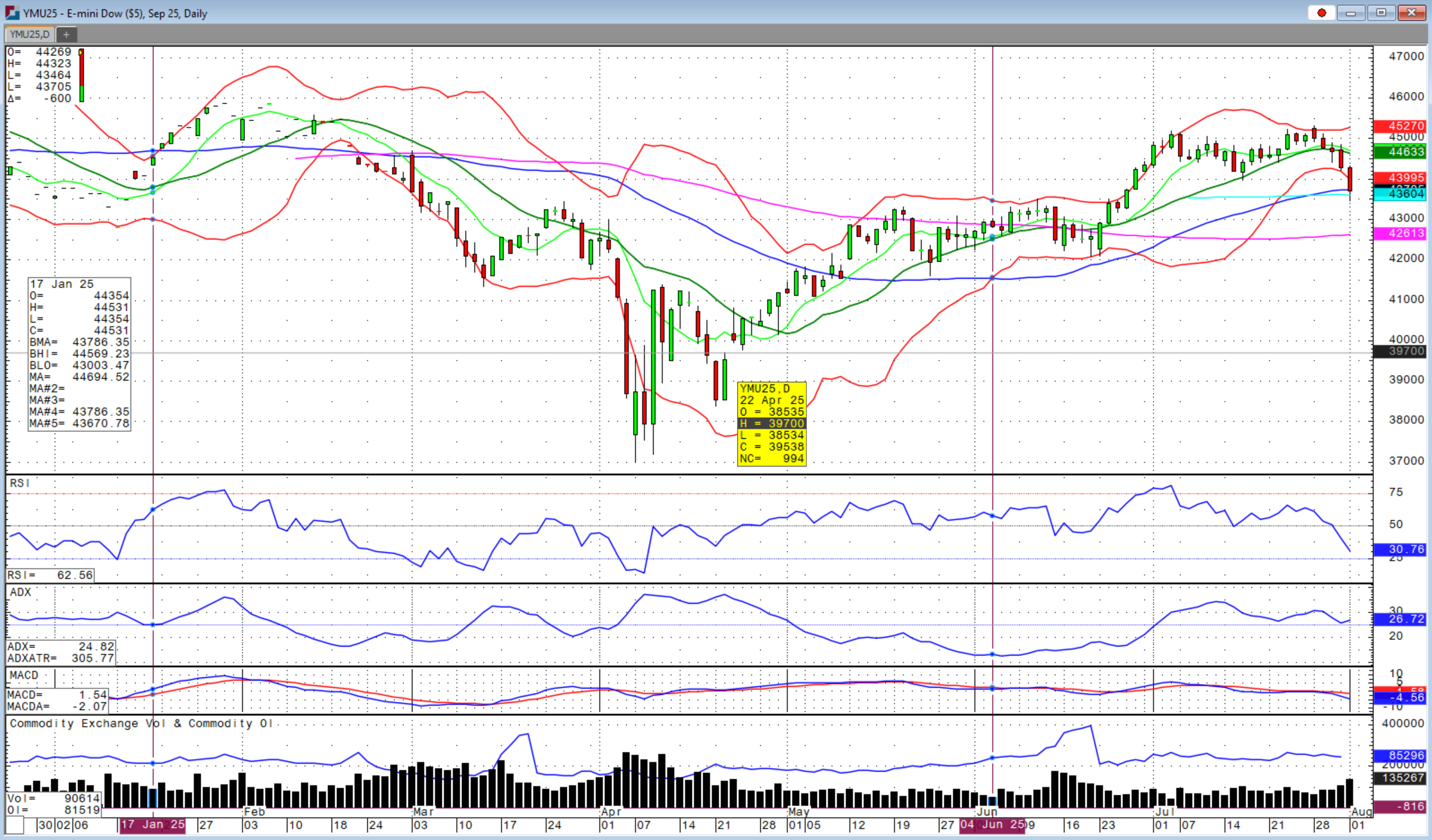

The resilience of the equity markets was tested to close out July and start the new month with the Dow Jones losing over 1,600 points from Monday’s high to Friday’s close. Other indices were stickier, but suffered from increased selling pressure on Thursday, the end of the month, into the week’s close. Friday’s jobs report of only 73,000 non-farm payrolls created in July was disappointing for the market as well as for Trump who later fired the Commissioner of Labor Statistics citing the “need to report accurate jobs numbers.” Well, okay.

Despite much consternation to the President, the FOMC decided to hold interest rates steady again this week. However, there were two dissenting votes of the twelve. After Friday’s monthly jobs report, the likelihood of a September interest rate cut are increasing as will the rhetoric suggesting the Fed does so.

As I wrote at the beginning of this Administration’s move back into the White House, I foresaw large and meaningful changes to government agencies, some of which that could be surprising to some. I still think we are just at the beginning of the grand plan. Last week’s announcements that the USDA’s DC headquarters would be reallocated to regional offices is one such move that is being contested by Congress. However, I believe there is much more to come in how government programs are administered and funded and so stay alert.

The digitization of USDA programs is also a much-needed upgrade that is long overdue. The range and complexity of programs available to producers could be greatly streamlined with digitization of the universe of what is available. Generative AI could significantly assist new and existing producers alike of programs to enhance the productivity and profitability of their operations as well as conservation where applicable. It is time, beyond time. Check out MyAgData (Home - MyAgData) for digitally reporting acreage reports and other services.

Favorable weather has continued to put downward pressure on crop prices. US corn conditions slipped one percent Good-to-Excellent this week to 73 percent, but still the best in 9-years for late July. Soybean conditions advanced two percent week-over-week and three percent above expectations at 70 percent G/E, the best in 5-years for late July and 2nd best in the last 11 years. Suffice it to say that there are big crops ahead, but demand news needed to balance what’s coming. However, ending stocks still remain tightish. A deal, even partial, with ag purchases attached could be a major boost and I do expect it will be part of the negotiation with China as it was last time.

Spring wheat conditions declined three percentage points to 49 percent G/E, well below last year’s 74 percent. This should provide underlying support to the wheat complex, but it has been difficult this week for all contracts to do anything but chop sideways with Chicago wheat making a new low on Friday, closing nearly at the low. Winter wheat harvest has now been called 80 percent complete versus 82 percent expected as rain continues to slow progress. We are beginning to hear reports that the Russian and Ukrainian wheat harvests are smaller than expected due to June heat.

The recent rebound in the US dollar has been a headwind for grains, but we did see a selloff Friday that could lend support into next week with greater odds of a Fed cut at the September 16-17th meeting. Before that time, the Kansas City Fed will be hosting the annual Jackson Hole Economic Policy Symposium from August 21-23rd where more light will be shed on conditions ahead of the FOMC interest rate decision. The other side of this however was news that the US economy (GDP) grew by 3.0 percent in the 2nd quarter versus a contraction in Q1. My feeling is that there are pockets of weakness in the economy that are being overshadowed by macro data that is not capturing the nuances that could develop into broader uncertainty and a credit crunch.

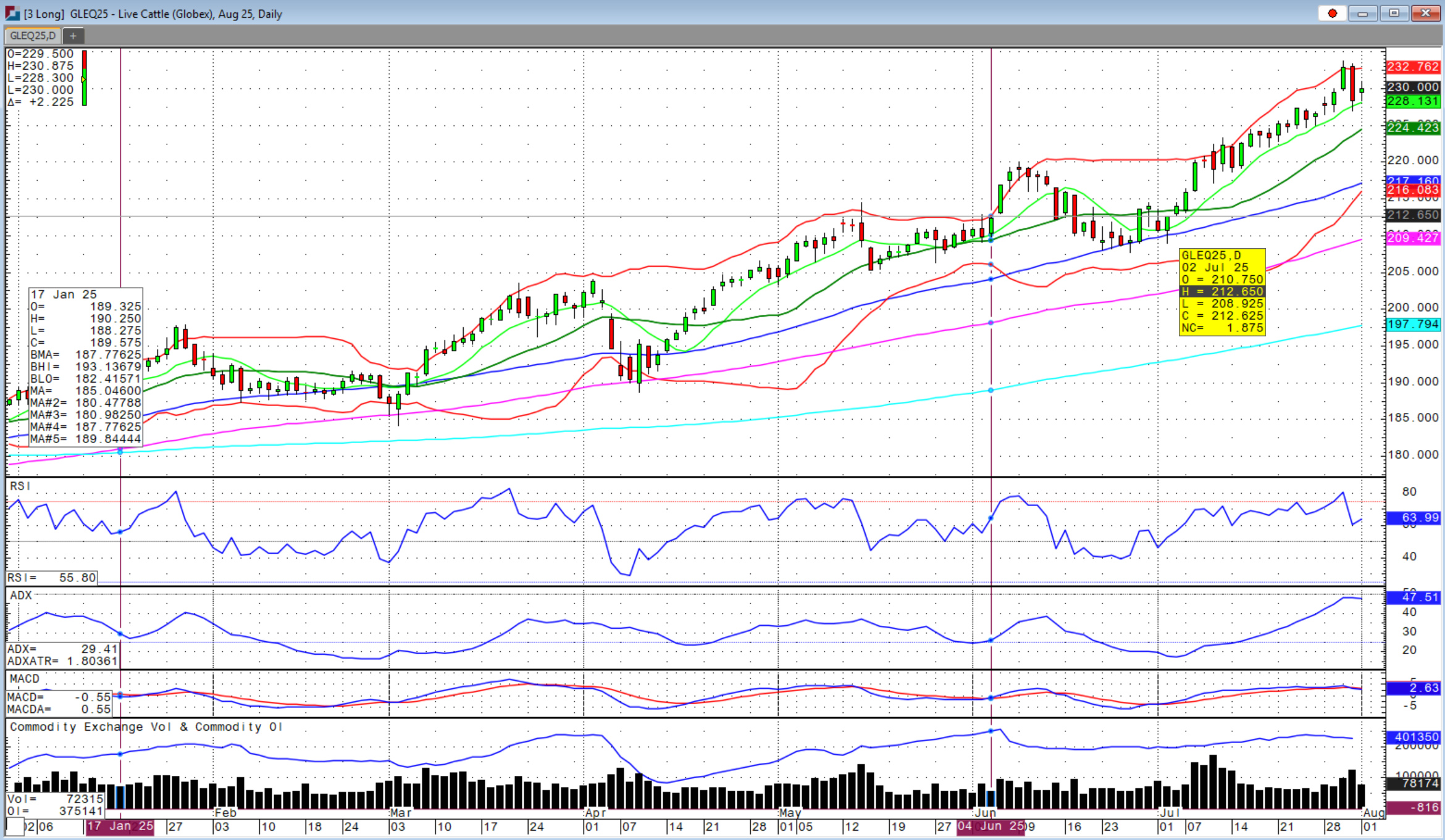

The cattle market finally showed some signs of change this week after making new highs on Thursday before finishing the session with an outside reversal lower day and close below the 9-day moving average, which hadn’t happened since June 26th for August feeder futures. The bulls remain in firm control of this market. In fact, it is nearly impossible to find a bear and rightly so, but these are the euphoric times that concern me. It is so easy to get chopped up in this market with daily limits now at $9.25 per cwt and expanded limits of $18.50 per cwt.

Tariffs of an additional 50 percent go into effect on all Brazil imports including beef on August 6/7th. It still feels like Brazil beef in the US is new, but it already represents 26 percent of US beef imports in 2025, surpassing Australia. Higher taxes on Brazilian beef, which are likely temporary, could cause short-term shortages in domestic supplies and higher prices as importers may “wait out” the policy struggle.

Feeder contracts made new lows early in the session Friday after Thursday’s big break, but closed positive with most contracts closing at or near the 9-day moving average. Fed cattle futures held at or above Thursday’s lows with cash trade concluding with highs at $235 in Texas, $236 in Kansas and $247 in Nebraska, but lighter volumes. Next week’s action in the cattle complex will be important to see if we are headed to $350 in feeders and $250 in fats or if we are going to chop and correct and run for those levels in Q3 when we usually hit the highs.

If you’ve waited to protect cattle prices, congratulations! However, don’t let your luck run out and be standing unprotected with these historically high prices in the rearview mirror. This level and pace in the market is one in which if you lock in prices within $20-30 per cwt of the high, you’re lucky and so don’t beat yourself up for being in that range as it is just as easy to be $100 per cwt out with this volatility and ferociousness of the funds. Just remember, everything can change when you’re least expecting it.

A final word on StoneX’s acquisition of RJ O’Brien that closed on Thursday, July 31, 2025, another historic event. Sidwell Strategies is now a StoneX/RJO Brokerage. It was a surprising development when we first learned, but are very excited about its advantages with Sidwell Strategies now fully powered by the combined resources of StoneX and RJ O’Brien. In addition to futures and options, our group of companies now offers the full array of OTC and managed fund products in addition to the Flex HTA contracts that we’ve been offering. Much more to follow on these expanded services for our producer as well as investor clients.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.